Fairfax County Real Estate Taxes 2025: Rising Taxes, Market Insights, and Opportunities

Fairfax County Real Estate Taxes in 2025 are a central topic of discussion, with significant implications for homeowners, businesses, and the community. Staying informed about these changes is crucial for making smart decisions in today’s real estate market.

Key Changes in Fairfax County Real Estate Taxes 2025

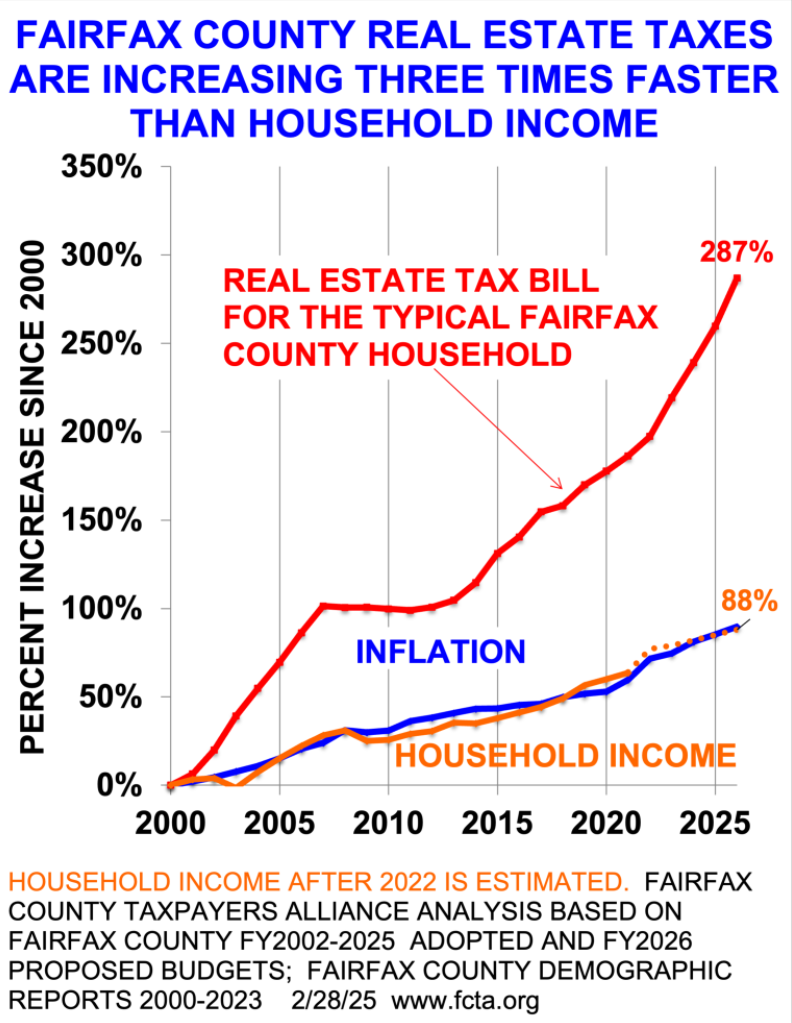

This year, Fairfax County has implemented notable adjustments to its property taxation framework. Residential property assessments have risen by an average of 6.2%, reflecting increasing property values across the region. Alongside this, the Board of Supervisors has approved a 1½ cent increase in the tax rate, resulting in a 7.5% overall hike—the largest in a decade. This adjustment will see the average homeowner’s annual tax bill increase from $8,659 to $9,312, marking a significant $653 jump.

In an effort to manage rising costs, Chairman Jeff McKay has proposed a new meals tax as an alternative revenue stream. While this measure may ease the financial burden on homeowners, it also places additional pressure on restaurants and other businesses that are already navigating complex tax responsibilities.

What Fairfax County Real Estate Taxes 2025 Mean for Buyers

For prospective buyers, these changes present a unique set of opportunities and considerations:

- Seize the Opportunity: The current financial pressures create room for buyers to negotiate favorable terms on homes.

- Plan for Affordability: Rising taxes might impact long-term costs of homeownership. By consulting a knowledgeable real estate agent, buyers can make informed, future-proof decisions.

What Fairfax County Real Estate Taxes 2025 Mean for Sellers

- Leverage Market Demand: Despite rising taxes, Fairfax remains one of the most desirable areas in Northern Virginia. Its proximity to major employment hubs and excellent schools continues to attract serious buyers.

- Maximize Your Sale: Sellers can work with experienced real estate professionals to competitively price their properties while showcasing standout features to achieve the best results.

Did You Know?

Fairfax County has expanded its Real Estate Tax Relief Program for seniors and individuals with disabilities, offering some financial respite to qualifying residents. Moreover, while residential properties are facing higher assessments, the commercial real estate sector is experiencing mixed results, with office spaces grappling with high vacancies even as retail and multi-family properties see modest gains. Click here

Navigating the 2025 Real Estate Market with Confidence

Understanding the latest changes in Fairfax County Real Estate Taxes in 2025 is essential for both buyers and sellers. While these adjustments present challenges, they also create opportunities for strategic moves. Whether you’re looking to purchase your dream home or sell your property at its peak value, partnering with an expert can make all the difference.

If you have questions, need advice, or want to explore your real estate options, I’m here to help. Feel free to reach out—I’d love to connect and guide you through the process!